Carol Anne Watts

Senior Director of Sales and Sales Operations

Freedom Energy

Published: September 19, 2023

One Year Later: The IRA’s Impact on Economic and Climate Fronts

In August 2022, the Inflation Reduction Act (IRA) made history as the largest climate bill ever enacted. This article takes a comprehensive look at the developments that have unfolded since its passage, exploring economic stimulus, climate initiatives, and ways businesses can tap into the available funds.

Fueling Job Growth: The IRA’s Drive for Renewable Energy Jobs

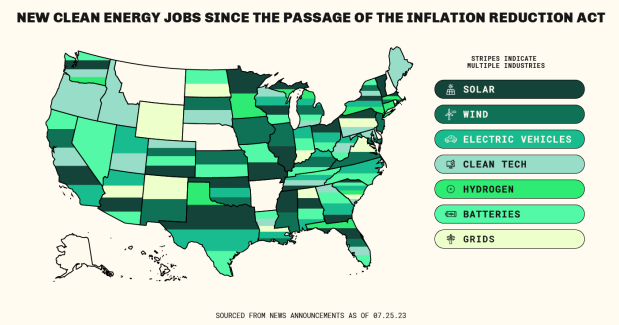

One of the fundamental goals of the IRA was to create domestic jobs in the renewable energy sector. Over 170,000 clean energy jobs have been created or announced over the past year (see graph). Over $110 billion in clean energy manufacturing investments have been declared, including more than $70 billion in the electric vehicle (EV) supply chain and more than $10 billion in solar manufacturing. As impressive as these figures are, they are just the tip of the iceberg. Some experts expect to see up to 1.5 million jobs over the next ten years.

Fast-Tracking Climate Goals: Decarbonizing Electricity with IRA

The IRA is putting America on the fast track to meet its lofty climate goals and decarbonize our electricity. With heavy investment in renewable energy, it is possible that the country will be using 80% clean electricity by 2030. In addition, the Department of Energy (DOE) estimates that because of many of these initiatives, greenhouse gas emissions could be reduced by 1 billion tons in 2030. Green power was historically not viable due to high price point and times of inconsistent production. However, with the investments being made in large scale resiliency, these projects are paving the way for further development in green technology.

Unlocking Opportunities: How to Benefit from IRA Programs

One year in, the IRA is being seen as a success on many levels, but how does the average consumer or business owner take advantage of the programs being offered? Here are five ways to participate:

- Energy Efficiency Projects

- Up to $5/sq ft deduction or ITC for HVAC or lighting upgrades, heat pumps, etc.

- On-site Energy Systems

- Investment Tax Credit (ITC) now available for standalone storage projects

- Since the implementation of the IRA, the tax incentive rate for solar and storage has increased to 30% (contingent upon meeting prevailing wage and apprenticeship requirements)

- Support local renewable energy

- Community Solar projects that are under 1 MW qualify for a 30% ITC through 2033, which should make them more accessible to consumers

- Production Tax Credits for alternative fuels

- Increased Production Tax Credits (PTCs) for emerging energy technologies related to hydrogen, carbon capture, and renewable natural gas with a potential 30% tax credit.

- Commercial Fleet Electrification

- Tax Credits up to $7,500 or $40,000, varying by weight of the vehicle

- Not subject to the same domestic manufacturing requirements as residential consumers

Not without scrutiny, the IRA has faced some criticism as callously overspending, however big changes require big action…and that’s just what the IRA is doing. A more sustainable future will require action and dollars committed to change. If you would like to discuss how your business can take advantage of the many programs being offered, please contact Freedom Energy Logistics and we would be happy to review what is available to you in your area.

Connect With Us