Carol Anne Watts

Senior Director of Sales and Sales Operations

Freedom Energy

Deciding when to execute an energy supply agreement can be a confusing and daunting task. Committing to buy multiple years of energy on a single day is a calculated risk that most energy buyers seek expert advice to help guide their procurement process. In reviewing the trends of the past few years, there are some patterns which could make right now the best time to buy.

But first, we must consider a few things:

1. When does your current agreement expire?

The end date of your current agreement will greatly impact when you choose to start looking for your next agreement, but should it? Our job at Freedom Energy is to advise clients on how and when to buy, in effect, creating better, more educated buyers. Good buyers are always shopping. Good buyers know what price they want to pay and are aware of the likelihood of achieving those rates. Here are some simple guidelines that may help you gauge how to time your next agreement:

Contract expiration date…

- Next 6 months, execute now

- Next 12 months, shop now

- Next 24 months, look now

- 24+ months, monitor forward markets and trends

The long and short of this guideline is to always be “shopping” and ready to buy — but there is more urgency with those that do not have a long runway to secure a rate. How will you recognize the low rate if you have not looked at pricing for over 36 months (or longer)? Comparing the current market to your current fixed price is not a good benchmark. Understand the charges and factors that affect your rate and why those may differ from when you last negotiated your supply agreement. If you are working with Freedom Energy, we are doing this active management for you behind the scenes. However, the same cannot be said for all firms and we would recommend you find a partner you trust to help manage these costs over time and who will make you aware of opportunities.

2. What are your future plans?

There are times when it makes sense to delay buying your next contract or only secure a portion of your load or price. Here are a few questions to ask yourself when deciding when to buy your next contract:

- How long will the business be in this location?

- Will there be any dramatic changes in usage over the next few years?

- Are there any green initiatives that may offset usage?

- Will there be any onsite generation that may shift the load from one commodity to another?

These questions suggest how your next agreement should be structured or if it makes more sense to wait and see. What is most important about these discussions are the contracts and language to support your potential plans. As Energy Advisors, we advise on many different types of risk, and contractual risk is often overlooked when doing a full product risk assessment. It is critical for the supply agreement to be in line with any expected changes to avoid penalties. If there are any causes to wait, those risks will be reviewed by your Advisor and possible alternatives suggested. For example, sourcing contracts that allow assignment or transfer of ownership, or deviations in usage up to a reasonable percentage. The risks of waiting may outweigh the risks of not securing an agreement, but it is important to understand the potential for penalties and cost of losing out on current market conditions before making a final decision.

3. Is now the right time to buy?

The question we get asked daily by energy buyers is the same, “Is now the right time to buy?” If you have already considered the last two questions and determined there is opportunity for you, here are a few data points to help further consider why now might be the right time.

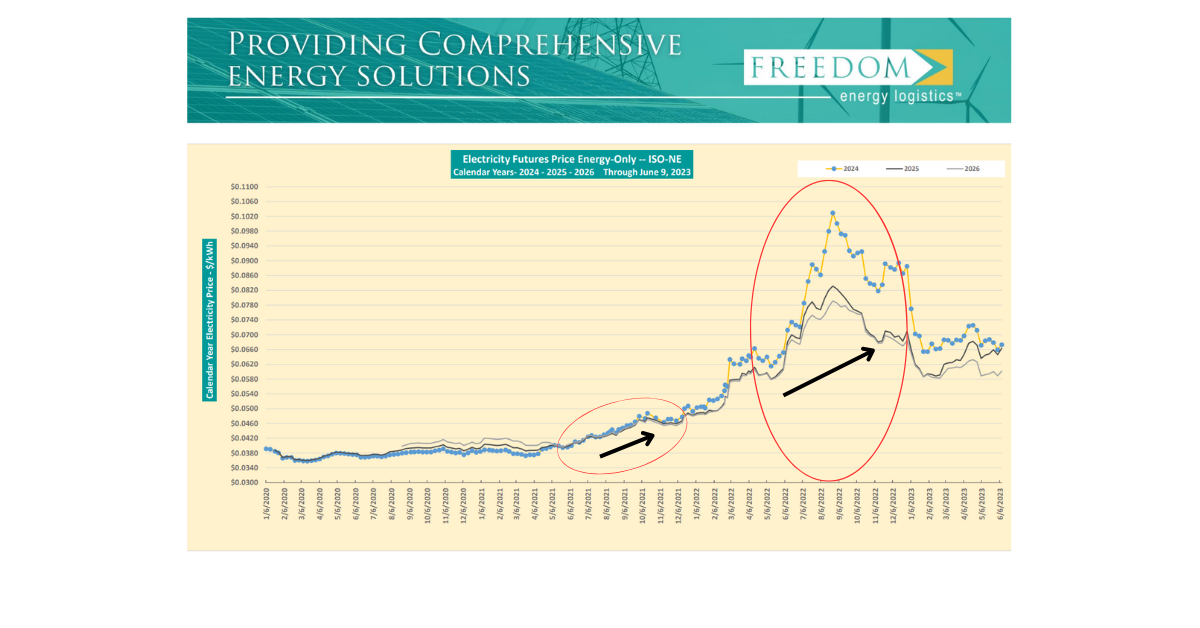

The chart above tracks the future cost of energy (CY24, CY25, CY26) in ISO-NE from January 2020 to present. Historically, from June to December of 2021 and 2022, prices only increased, and the best opportunity to buy for the coming year was May/June. Should 2023 follow this model, most energy buyers will not gain any market movement by waiting. We are coming off a mild winter and gas prices are trading favorably. Increased summer demand and speculation around next winter’s temperatures will only negatively impact forward curves. If fixing in 100% of your energy is still not appealing, I would examine hedging at least 50% under these market conditions. Your Energy Advisor at Freedom can help model different scenarios and set realistic expectations for what you can expect to pay should you decide to wait.

In conclusion, there is not one indicator or market driver that will determine the right time to buy for every energy buyer. It is more important to work with an Advisor who deeply understands your goals and needs and can alert you to opportunities as they come up during your agreement. Staying informed about current markets with customized, executable rates helps our clients buy better, buy smarter, and buy for less.

If you would like to learn more about how Freedom Energy’s team can help you become a better buyer, please reach out or email us at solutions@felpower.com.

Published: June 20, 2023

Connect With Us