Howard Plante

Vice President of Procurement

Freedom Energy

In mid-2022 as the Russia – Ukraine war continued, futures electricity prices for 2023 and beyond followed a pattern of volatility driven by natural gas prices. Speculation remained high as we headed into the Fall, and utility electricity prices for January and February 2023 reached highs never seen before, with Eversource NH supply rate hitting 48 cents/kWh in January for the large commercial and industrial classes. Natural Gas storage was very near the 5-year minimum. LNG (Liquified Natural Gas) exports to Europe and Asia were expected to remain high, putting additional pressure on natural gas prices and supply concerns into New England for the Winter, directly affecting electricity prices.

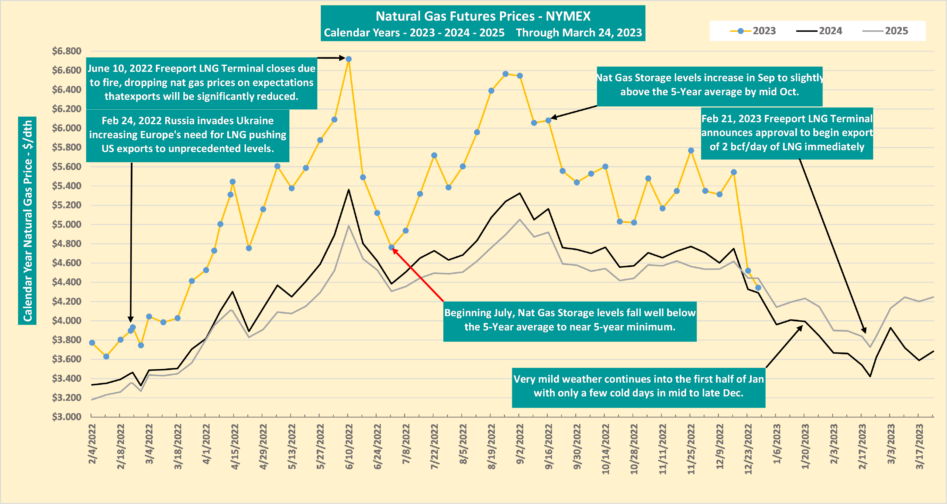

Table 1 depicts some milestones throughout 2022 that affected the futures prices of natural gas.

Table 1

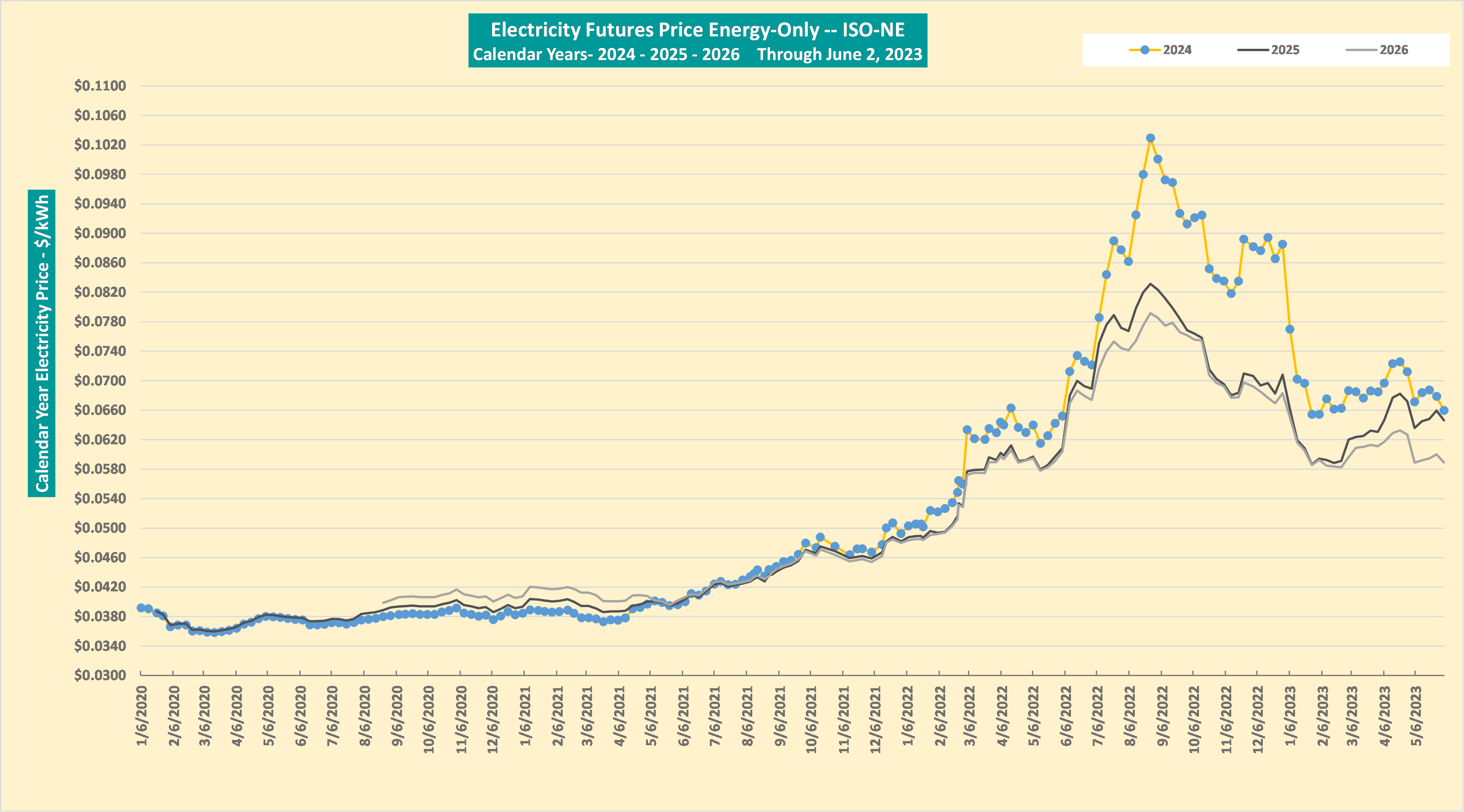

One of the mildest winters on record in the northeast, as well as a very mild winter in Europe, boosted natural gas storage to near the 5-year high, and kept real-time electricity prices in the wholesale market in check. Futures electricity prices had already begun to pull back in late Fall. In mid-August, electricity for calendar year 2023 was trading at 13.25 cents per kWh (energy-only). By the end of 2022, that same electricity could be purchased for 9 cents per kWh.

Table 2 depicts the volatility of electricity futures prices from the beginning of 2022 purchased for 2024, 2025, and 2026.

Table 2

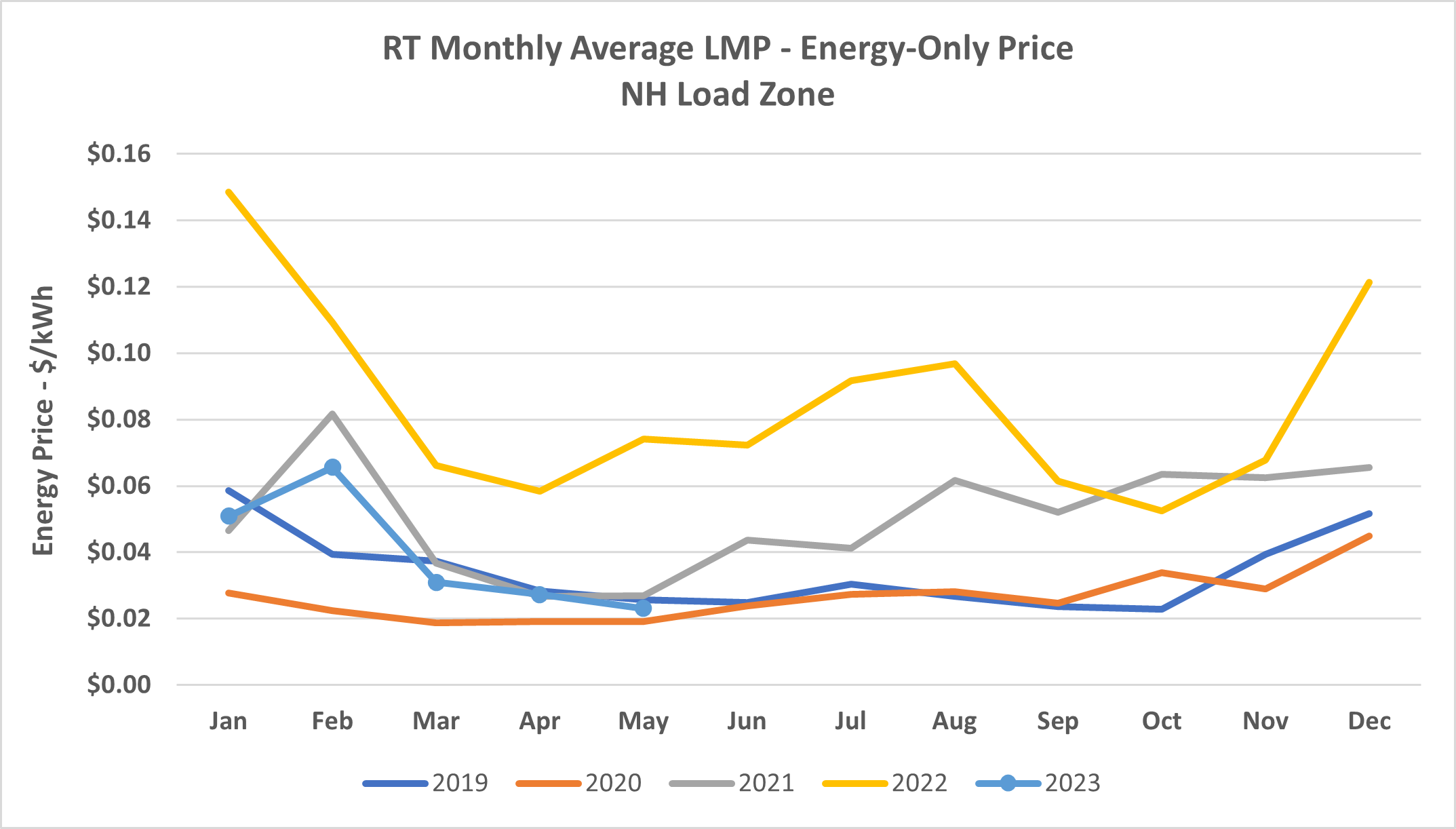

Real-time electricity prices in New England were saved by a very mild winter. The expectations were that prices could potentially spike to extremely high levels on extremely cold days, and there were very few of them. On December 24, 2022, the market price of electricity averaged 49 cents per kWh. With few exceptions to the very mild weather throughout the winter, prices remained in check, averaging approximately 5 cents per kWh for the 3-month January-March 2023 period.

Table 3 depicts the monthly real-time electricity prices (energy-only) for the past 4 years through May 2023 for the NH load zone. The other five New England states are similar.

Table 3

Forward Outlook

As we head into the summer, daily volatility of natural gas prices continues, but the swings are not as significant as we saw in the Fall of 2022. Temperatures have been mild in June, helping to keep real-time electricity prices low. The National Oceanic and Atmospheric Administration (NOAA) is predicting above average temperatures in the Northeast and hot humid days will likely cause some spikes in demand and electricity prices. ISO-NE (Independent System Operator New England) expects to have sufficient generating capability to meet the demand for electricity this summer, predicting a Peak Demand of 24,605 MW under normal weather conditions, and 26,421 MW with above average temperatures. The highest Annual System Peak was 28,130 MW in 2006.

The fundamentals have not changed. Global market conditions, and the US economy, will continue to affect the energy situation and prices in the US, and New England will continue to be held captive by natural gas prices and weather, most notably in the Winter months.

Published: June 20, 2023

Connect With Us