Howard Plante

Vice President of Procurement

Freedom Energy

With the three-month winter period behind us, I wanted to summarize where wholesale real-time electricity prices averaged and if they lived up to the concerns we had back in the Fall. There were several factors that led to those concerns and uncertainty of what the electricity prices would be in the spot market. And purchasing hedges at acceptable prices to cover the winter proved difficult as those prices continued to rise.

As we headed toward winter, ISO-NE indicated concerns of natural gas availability and other fuels that would leave them with challenging operating conditions if we were to experience very cold or extremely cold temperatures. Natural gas prices had been rising steadily the second half of the year with some high volatility occurring on a daily basis. Natural gas storage was below the 5-year average. The vast majority of LNG that would normally be offloaded in New England was expected to be exported to Europe and Asia where prices were commanding a premium. The increase in natural gas prices and speculation drove future electricity prices up considerably, with some utilities posting prices for January and February 2022 at unprecedented levels, as high as 31.2 cents per kWh. The global energy situation seemed to be affecting the US markets more so than in previous years. The expectations were that spot market electricity prices could soar beyond levels we hadn’t seen before. At the same time, the National Oceanic and Atmospheric Administration (NOAA) was predicting a milder than average winter providing some hope that prices would remain in check.

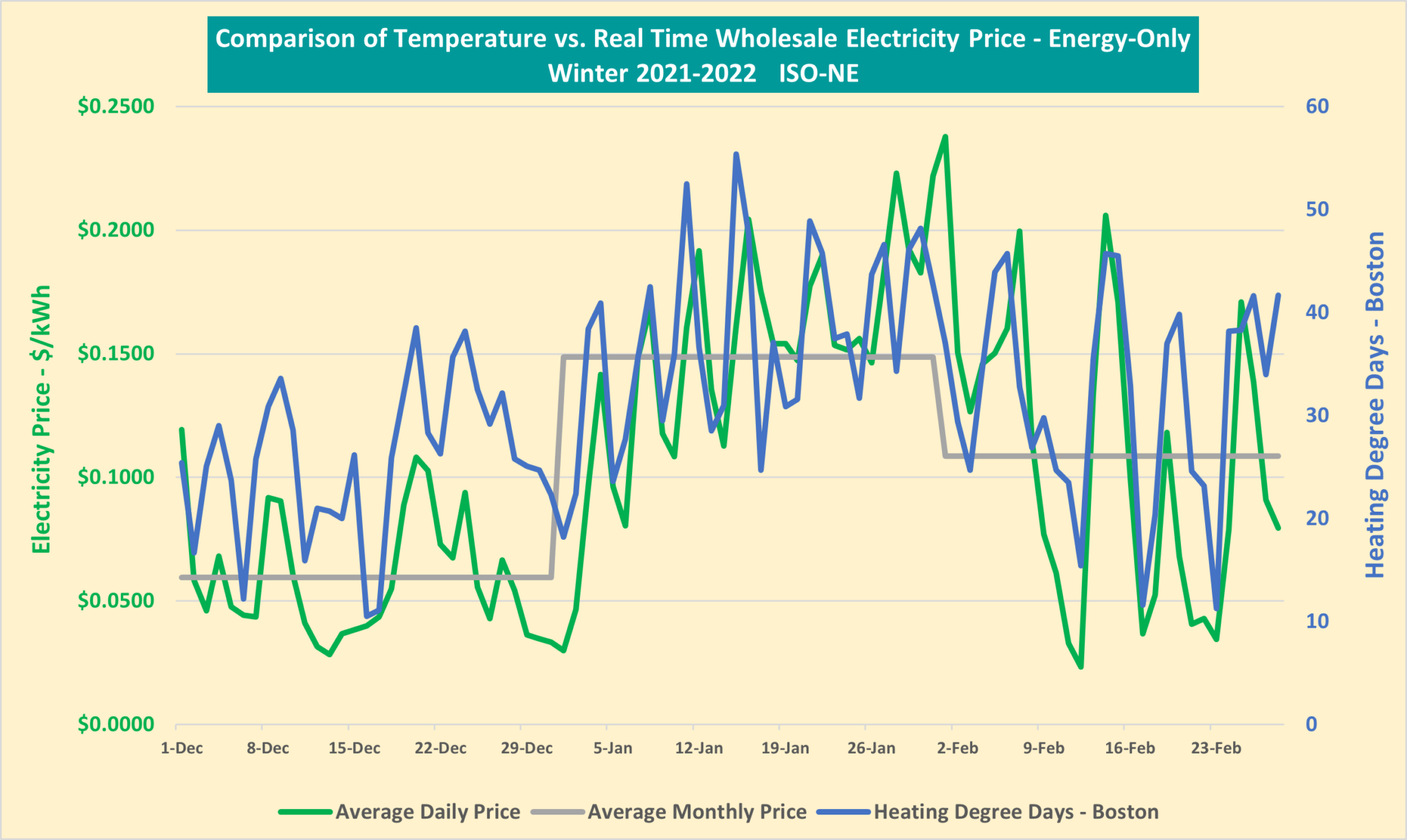

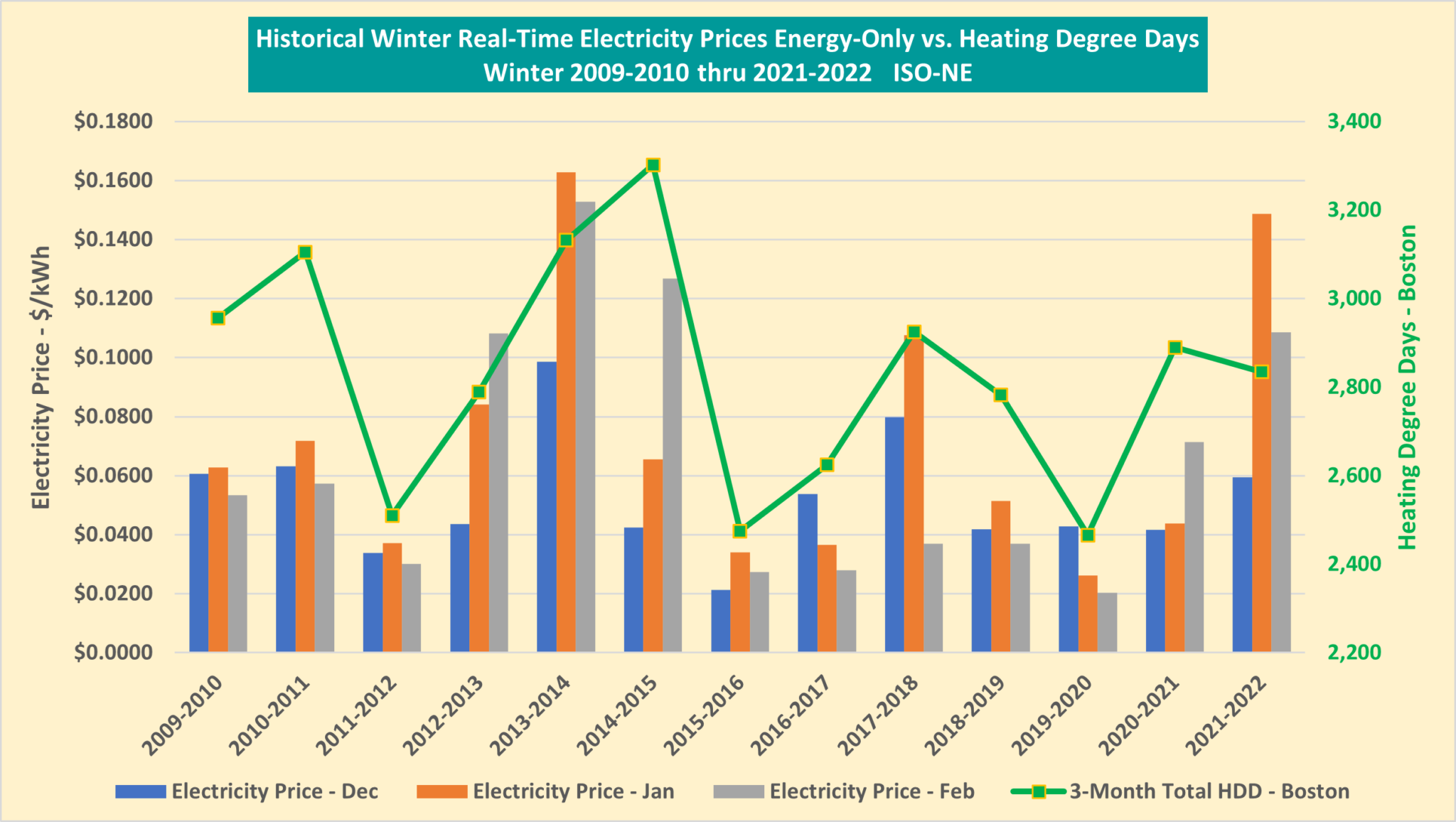

The results were interesting, and Chart 1 shows that prices varied as expected based on temperature. While prices weren’t unprecedented during the cold spells, I think on average they were higher than in some previous winters for the same weather conditions displayed in Chart 2 (natural gas prices the main driving factor).

In spite of the speculation and concerns, the real-time market was still capable of producing some low prices on days when temperatures were mild. Using Boston as the basis, December was the fourth mildest since 1999-2000, January was the sixth coldest and February was the eighth mildest.

Forward Outlook

We are continuing to see day-to-day volatility of natural gas prices which have been further affected by Russia’s invasion of Ukraine. Forward electricity prices are following suit with January and February of 2023 trading close to 20 cents per kWh. During the first week of March, the 2023 12-month electricity strip jumped up 1.1 cents to 8.3 cents. Beyond 2023, electricity prices are lower but remain elevated with 2024 in the low 6 cent range and in the high 5 cent range for 2025 and 2026. The sanctions against Russia, including most recently the US sanctioning of Russian oil will continue to add risk to natural gas and electricity prices in New England. The consensus is that futures prices will remain elevated and volatile for the near future and very likely through 2022.

About Freedom Energy Logistics

Founded in 2006, Freedom Energy Logistics is a leading energy advisory. The private company offers comprehensive energy supply management and renewable energy solutions supporting energy goals and sustainability objectives for businesses and organizations throughout the U.S. Freedom’s team of energy experts has worked with and delivered energy saving, environmentally responsible solutions for some of the largest commercial and industrial companies, municipalities, universities, healthcare facilities, and businesses. With its headquarters located in Auburn, NH, Freedom Energy also has employees serving clients locally throughout the regions. Freedom Energy has been twice named to the Inc. 5000 list of fastest growing companies in America; recognized as one of the Fastest-Growing Family Businesses in NH by Business New Hampshire Magazine. Stay Work Play’s Coolest Company for Young Professionals; and received multiple Business Excellence Awards from New Hampshire Business Review.

Connect With Us