PJM Capacity Auction (BRA) Continues to Drive Consumer Costs Upward

PJM’s latest capacity auction continues the trend of rising costs, with prices hitting the FERC-approved cap of $329.17/MW-day—adding roughly 5% to consumer supply costs on top of 2024’s increases. Freedom Energy advises organizations to use peak load management and demand response programs to reduce exposure and offset these higher charges.

Context from Previous Auctions

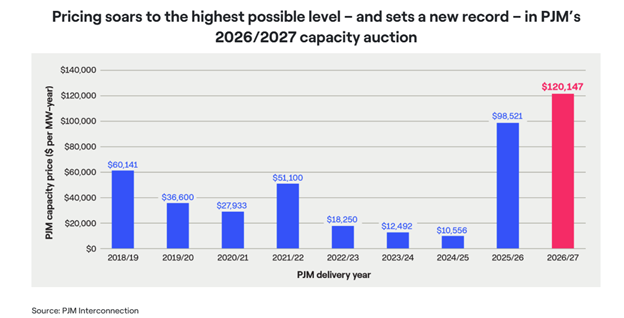

As noted in our 2027 PJM capacity article, the 2024 PJM BRA revealed a staggering increase in capacity costs. The article highlighted the growing challenges of grid reliability amid the transition to renewable energy and increases in demand from AI. The 2024 auction results indicated a 9-fold increase in costs, creating significant implications for consumer electricity rates. These implications materialized in 2025, effectively creating substantially higher rates in the PJM market.

Latest July 2025 BRA Results

The latest July 2025 BRA is a continuation of this upward momentum that further impacts consumer electricity rates. While the latest auction was not the staggering increase we saw in 2024, it still produced further increases throughout the region.

Figure 1

Auction Details & Price Points

The PJM 2026/2027 Base Residual Auction (BRA), secured 146,244 MW of unforced capacity generation (UCAP) to meet the demand needed across 13 states and the District of Columbia. The price came in at the FERC-approved cap, $329.17/MW-day (UCAP), for the entire PJM footprint. This price compares with $269.92/MW-day for the 2025/2026 auction for the RTO. This could equate to an additional 5% increase in consumer’s supply costs, on top of the 25% impact from the July 2024 BRA.

Why Prices Keep Rising

Data centers in PJM have been largely concentrated in Virginia, the largest data center market in the world, where Amazon has the largest footprint. Additionally, data centers are spreading to other zones, particularly in Ohio and Maryland. Projected data center growth is expected to run into constraints, in terms of the pace at which the utility can build infrastructure (typically several years longer than the time required to build a data center).

Looking Ahead to the 2027/2028 Delivery Year

The next Base Residual Auction for the 2027/2028 Delivery Year is scheduled for December 2025, as PJM works toward resuming its three-year-forward planning cycle. The expectations are for the auction to clear at the price cap ($329.17/MW-day) due to anticipated tight supply and reduced eligible capacity. Analysts expect high prices because new generation has had difficulty connecting to the grid, and there’s a continued decrease in eligible capacity.

How Organizations Can Minimize the Impact

It is important to understand how organizations can minimize this impact to their bottom line. The key to minimizing the additional costs is peak load management and energy efficiency. At Freedom Energy we provide the Peak Notification Program. This program reduces demand-based charges, such as capacity and transmission costs, by curtailing an organization’s load when notified of peak demand hours on the grid.

There are 5 critical peak days in PJM that are considered in formulating a cap tag. Suppliers base the capacity cost on this tag. When proper management and curtailment is done, significant cost reductions can be absorbed. Additionally, we have partners that we work with to provide Peak Demand Response which can enable an organization to generate revenue through participation in load response programs. Please contact a representative at Freedom Energy to review options.

Meet the Writer

Josh Mitera

Freedom Energy Logistics

Regional Sales Manager

Josh Mitera is the Regional Sales Manager at Freedom Energy Logistics, dedicated to delivering tailored energy solutions and supporting clients in achieving their energy goals. His expertise in sales and energy strategy makes him a trusted partner for businesses navigating the evolving energy landscape.

Connect With Us