Sean Devine

Director of Natural Gas Sales

Freedom Energy

Published: December 14, 2023

Navigating the Transition from Autumn to Winter in the Natural Gas Market

As we bid farewell to the fall months and we enter the winter season, the world of natural gas undergoes a significant shift, particularly in the Continental United States. This period marks the shift from weekly injections into natural gas storage facilities to the commencement of storage withdrawals, a pivotal change in the natural gas cycle.

The Influence of Weather on Natural Gas Storage

Weather plays a crucial role in both the storage injection and withdrawal seasons. During the spring, summer, and fall, the natural gas storage facilities are so the gas can be released during the cold months where demand outstrips supply. The main driving factor is weather during both storage injection season as well as storage withdrawal season. If the weather is very hot during injection season, and the LNG export facilities are running at full capacity, we will see less gas injected into storage due to high demand. If there is mild weather and power generation facilities fueled by natural gas are not running at full capacity, we typically can expect to see higher levels of injections into storage facilities. If demand for power is high due to unseasonably high temperatures, and LNG export facilities are at full capacity, we typically see lower levels of injections. While rig counts have been consistently lower than 2022, American ingenuity and improvements in efficiencies, have proved to increase production from individual rigs.

2023’s Unique Storage Dynamics

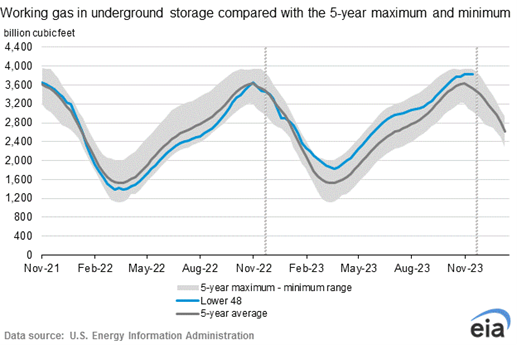

Interestingly, despite a consistent decrease in rig counts compared to 2022, American efficiency and innovation have led to increased production from individual rigs. The December 8 2023 Storage Report published a 117 BCF withdrawal for the week ending December 1, surpassing market expectations of a 109 BCF withdrawal. This has resulted in unusually high storage levels as we enter the peak demand winter months.

Comparative Analysis with Previous Years

Natural gas storage levels were reported at 3,719 BCF. Compared to the 5-year average, current storage levels are 6.7% higher, and are currently 7.3% higher than same time last year. European storage levels are also looking good going into the winter months due to mild weather over the summer and fall, allowing Europeans to minimize worries of fuel security issues.

Forecast and Impact on Natural Gas Pricing

The forecast for continued mild weather could lead to further bearish market corrections. With both Europe and the United States boasting high storage levels, natural gas pricing fallen off, avoiding the typical pre-winter surge. However, as we enter the peak demand season, this scenario can rapidly change, with weather once again becoming a critical determinant.

The Role of the EIA Storage Report

The Energy Information Administration (EIA) Storage Report, released every Thursday, plays a significant role in shaping natural gas futures and pricing. It details the levels of weekly injections or withdrawals. If a cold winter arrives, and we all know it will show up at some point, the storage facilities will begin the withdrawal season choc full, and ready to respond to demand.

Connect With Freedom Energy

Want to stay ahead in the natural gas market? Get the latest insights and detailed forecasts. Contact our team Contact Us or follow up on LinkedIn for updates on natural gas and market trends.

Connect With Us