Carol Anne Watts

Senior Director of Sales and Sales Operations

Freedom Energy

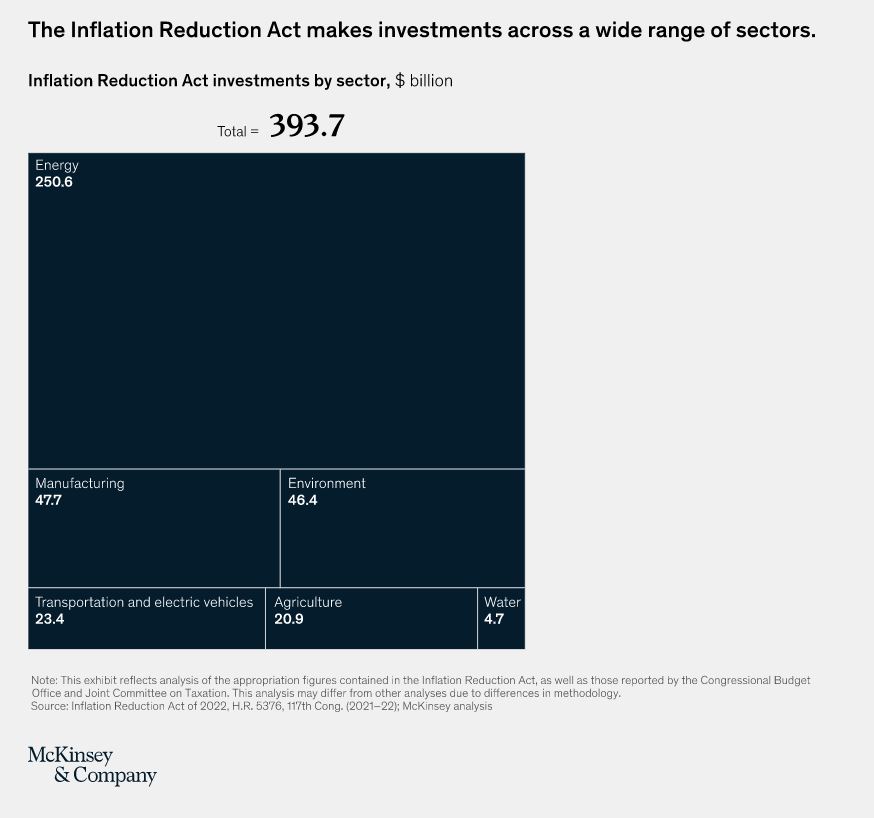

In August 2022, President Biden enacted the $739 billion Inflation Reduction Act (IRA). The IRA aims to curb inflation through historic deficit reduction measures. Among many initiatives, clean energy is a significant driver of the IRA, to nearly $400 billion worth of tax incentives, grants, and lending programs.

Here is a breakdown of the clean energy-associated funding allocations over the next 10 years1:

What is the Impact?

The IRA will include $270 billion in funding available in clean energy tax provisions, the most extensive program ever created and dwarfing the previous $20 billion package of the Obama administration. Much of the funding will not be available to the average consumer or business owner and comes in the form of rural energy development, forestry conservation, and a methane fee targeted at oil and gas transport. However, there are large carve-outs for residential efficiency rebates, electric vehicles, and other clean energy technologies (extending and expanding previous initiatives).

As a consumer and business owner, $43 billion in tax credits will make many previously cost-prohibitive technologies more affordable. In addition, new technology, like battery storage, is now included in the IRA to expand clean offerings accessibility. As depicted in the table2 below, solar energy system tax credits have ballooned to 30% (previously 22%) for the next decade and only stepped down slightly in the years following.

| Residential Clean Energy Tax Credit amounts apply for the prescribed periods: |

| 30% for property placed in service after December 31, 2016, and before January 1, 2020 |

| 26% for property placed in service after December 31, 2019, and before January 1, 2022 |

| 30% for property placed in service after December 31, 2021, and before January 1, 2033 |

| 26% for property placed in service after December 31, 2032, and before January 1, 2034 |

| 22% for property placed in service after December 31, 2033, and before January 1, 2035 |

Tax credits also tripled for many other energy-efficient upgrades and purchases made by homeowners, such as heat pumps. Previously allowing for 10%, these upgrades are now eligible for up to 30% tax credit on qualified purchases.

The IRA amended existing electric vehicles (EV) and charging stations provisions. New requirements aim to create more domestic jobs with the mandate of the final assembly of qualifying EVs in North America.

For those purchasing an EV, the $7,500 tax credit has been extended until 2033. Regarding EV charging equipment, the tax credit will remain the same on a residential level. However, on a commercial level, stipulations have been imposed which require the charging stations to be installed in low-income or rural communities. It is widely recognized that access to charging is a barrier to entry for many considering an EV, and thus the incentives were tailored to address problem areas.

What is the Goal?

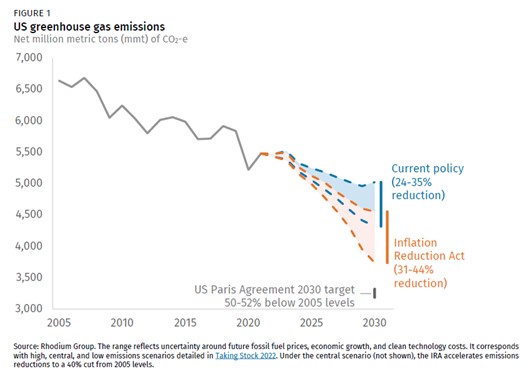

Energy is only one aspect of the IRA, but it is the most impactful initiative the country has taken against climate change thus far. The measures which have been set forth are predicted to decrease US GHG (Greenhouse Gas) emissions by up to 10% more than previous policies (see chart).3 Although they still need to get us to the goals of the US Paris agreement signed in 2015 (50% reduction of GHG emissions compared with the levels of 2005), the IRA could bring the US closer to this goal by 2030.

In short, “The Inflation Reduction Act makes a historic commitment to build a new clean energy economy, powered by American innovators, American workers, and American manufacturers, that will create good-paying union jobs and cut the pollution that is fueling the climate crisis and driving environmental injustice.”

Published: March 17, 2023

Connect With Us