Howard Plante

Vice President of Procurement

Freedom Energy

During the late summer and fall of 2022, as we continued to plan strategies for the winter, the global energy situation was a major consideration. Concerns were that energy prices could reach unprecedented levels. Included in those concerns were the following:

- Utilities were maintaining plans for potential controlled power outages if needed.

- Utility electricity prices reached levels never seen before

- Europe was highly dependent on LNG imports which would have reduced the amount of LNG that would remain in the US.

- ISO-NE was implementing plans and procedures, including a rolling three-week energy supply forecast to mitigate prolonged periods of cold weather.

- Natural gas storage levels were well below the 5-year average and close to the 5-year minimum.

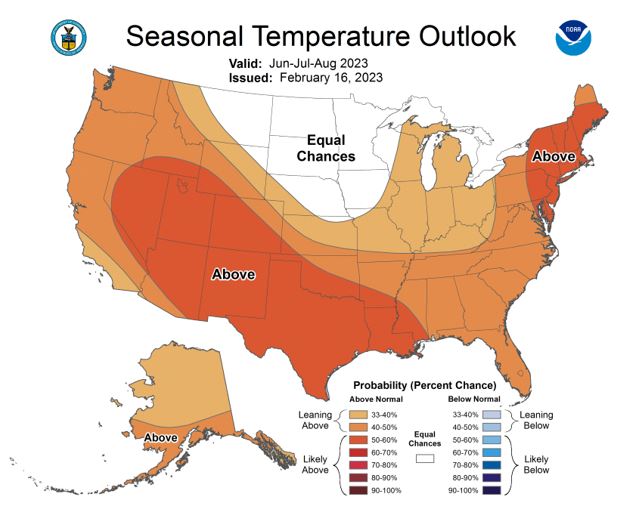

Although National Oceanic and Atmospheric Administration’s (NOAA) seasonal outlook predicted above-average temperatures from December through February1, several days of extreme cold weather could have presented problems.

How did the winter conditions compare to anticipations? Except for a few very brief cold bursts on Christmas weekend and the weekend of February 3, temperatures overall were well above average, with Boston seeing the 5th warmest winter on record. The mild temperatures in Europe reduced the need for LNG imports and in New England to supplement natural gas shortfalls.

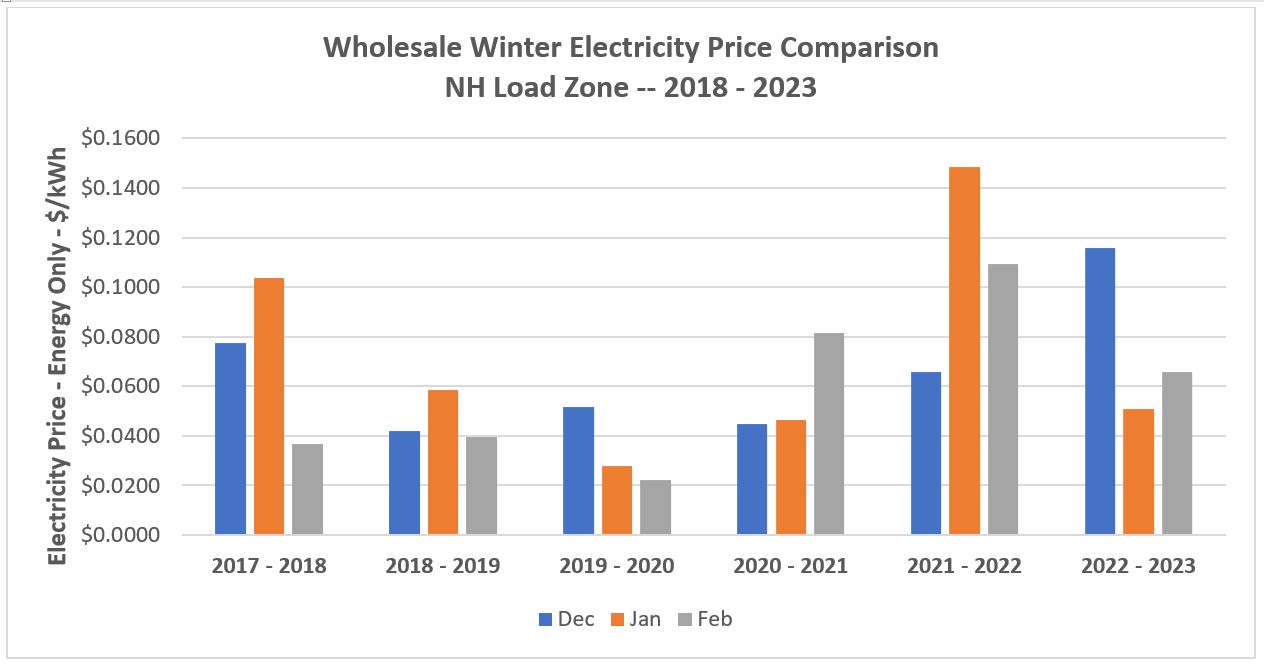

Christmas weekend may have given us a glimpse of what we could have expected with prolonged cold weather, where electricity prices in the wholesale market averaged 49 cents per kWh on December 24. However, during the February 3 weekend arctic blast, wholesale electricity prices averaged 13 cents and 28 cents on Friday and Saturday, respectively. Otherwise, the average electricity prices for the 3-month period were much lower than expected and relatively normal. A very mild winter in New England and Europe was the most significant factor contributing to natural gas storage that was slightly above the 5-year average, which was not expected.

The chart above depicts the energy only electricity prices in NH for the past six winters.

What do we anticipate going forward?

As we head into spring, we continue seeing relatively low prices, as expected. Spring and fall typically produce the lowest electricity prices due to the reduced demand when cooling and heating loads are minimal. March to date is at approximately 3.5 cents per kWh. While there will likely be days with elevated pricing due to weather and other circumstances, we should see reasonably stable pricing for the next few months.

During the summer, we expect prices to rise as cooling requirements increase electricity demand. Natural gas pricing will continue to dictate electricity prices predominantly. As of February 16, NOAA predicts above-average temperatures in New England from June to August. Extremely hot days will result in elevated prices but should only persist as long as the heat spell.

Futures electricity prices for the 2023-2024 winter are trading well below the highest prices we saw this past winter, with January and February 2024 at approximately 14 cents per kWh. January and February 2023 were trading as high as 34 cents per kWh during the fall of 2022.

While the market has settled down for now, the global markets will continue influencing prices in New England. As a result, we may see elevated winter 2023-2024 futures prices again at some point this year. However, as we saw this past winter, weather, and temperatures will determine the wholesale pricing. Freedom Energy will continue to keep you apprised of any issues that will affect prices in the future.

Annual System Peak 2022

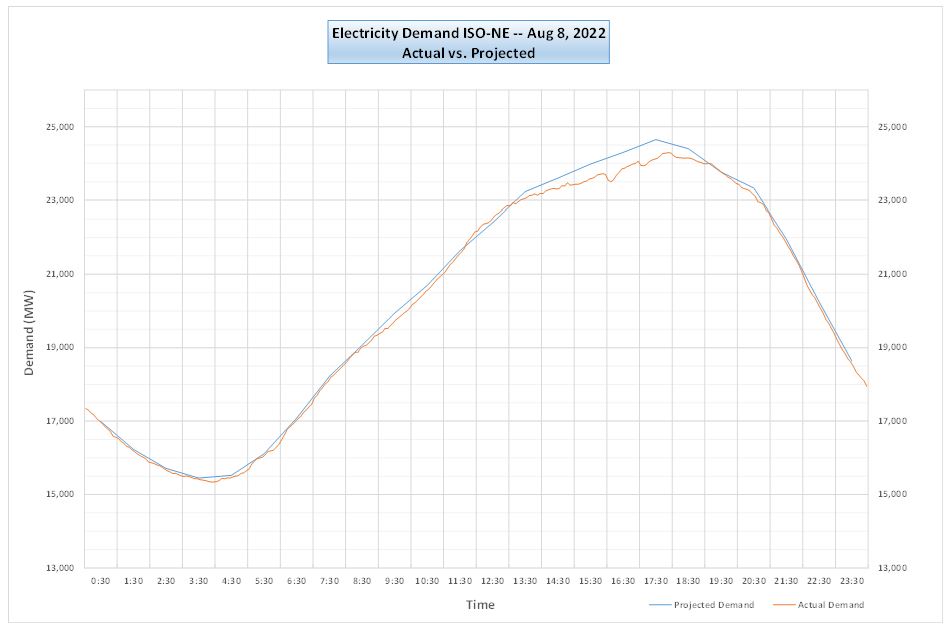

In the past few weeks, ISO-NE confirmed the Annual System Peak occurred on August 8, 20222, at hour ending 4:00 PM (3:00 PM – 4:00 PM). While the data and demand curve on that day clearly depicts the apparent peak as an hour ending at 6:00 PM, as shown below, ISO-NE has qualified the data as 4:00 PM.

In past years there have been hours and days that were very close. The difference between 4:00 PM and 6:00 PM appears significant. We will report further explanations as we obtain feedback from ISO-NE.

Published: March 17, 2023

Connect With Us