March 2024 Freedom Energy Newsletter

Natural Gas Prompt Price in Rare Territory

Howard Plante, VP of Procurement, discusses the rare occurrence of natural gas prompt month prices dropping below $2 per million BTU, a level that has been breached only a few times since 2014. He highlights the market’s self-correcting nature, where supply and demand dynamics lead to a rebound in prices, and shares insights into the EIA’s forecasts for higher average spot prices in 2024 and 2025, driven by an expected increase in demand outpacing supply.

Published: March 21, 2024

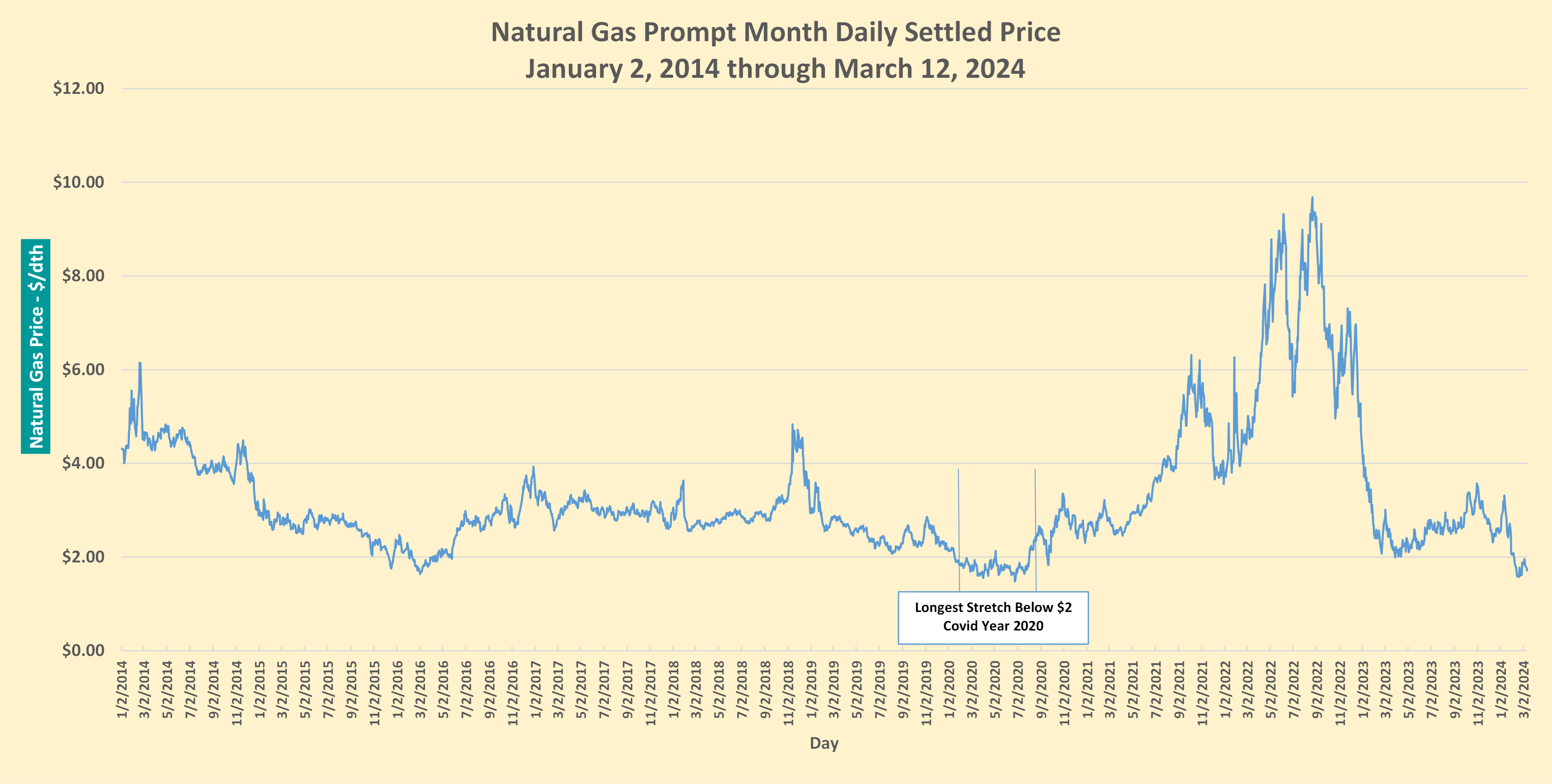

Natural gas prompt month price recently did something it rarely does. It dropped below $2 per million BTU beginning February 7, 2024. With Covid year 2020 as the exception it has only breached the $2 level a few times since 2014. And it didn’t stay there very long. In the ten-year period from 2014 – 2023, only 3 of the years saw any days where prompt fell below $2. Historically whenever it drops this low, it bounces back fairly quickly.

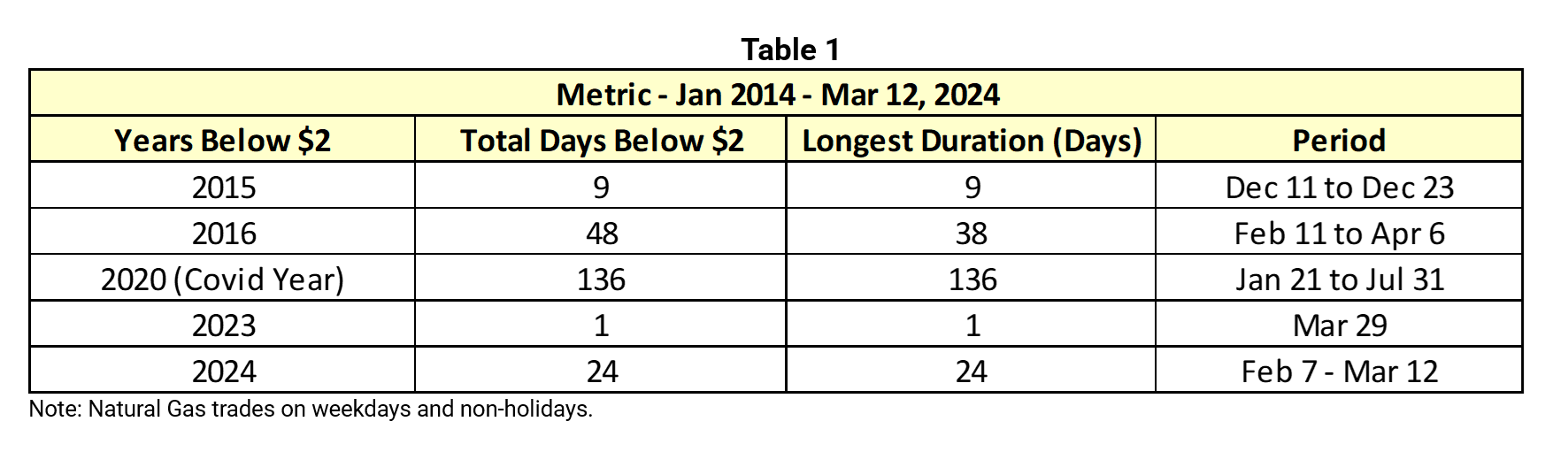

Natural Gas Price Frequency Below $2 per MMBTU

It seems that it cures itself when it gets too low. Supply and demand are always the end result of all the other factors, globally and in the US, including US LNG exports. When the price drops below a profitable level for producers, they stop producing. Less production creates less supply, and prices rise.

We are currently in a 24-day stretch below $2 but it probably won’t last long. 2020 was an anomaly that plunged demand but by the time August rolled around, it started on an uphill drive. Analysts are expecting a rebound in 2024. Table 1 depicts the years since 2014 that the price fell below $2 and for how many days.

Outlook for Natural Gas Prices in 2024 and 2025

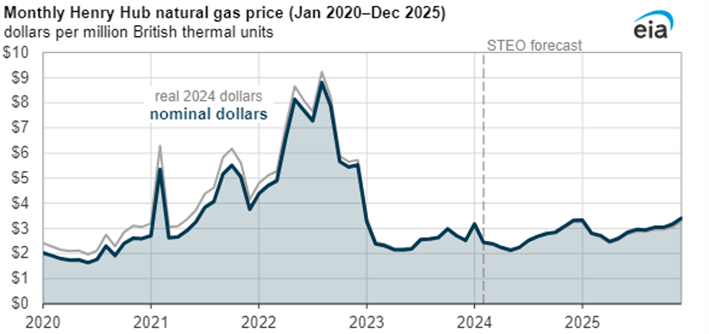

The US Energy Information Administration expects the natural gas spot price to average higher in 2024 and 2025 compared to 2023, with demand to grow faster than supply in 2024. In 2022 and 2023 increases in supply, including us production and imports exceeded demand. The EIA expects the opposite in 2024, where demand increases and supply remains relatively flat.

Data source: U.S. Energy Information Administration, Short-Term Energy Outlook (STEO), February 2024

Data values: Energy prices

The EIA is forecasting that most of the increase in US supply in 2025 will come from US production. However, if US crude oil production is less than expected, we may see less natural gas production than forecasted. Crude oil prices have a significant affect on crude oil production. If prices remain high, producers drill to produce more oil, and reduce drilling when oil prices are low. As a result, reduced oil production can reduce natural gas production because some natural gas is produced from oil wells.

Based on natural gas historical price information regarding the $2 level frequency and duration, EIA forecasts for 2024 and 2025, this current market may be short-lived.

Meet the Writer

Howard Plante

Freedom Energy Logistics

Vice President of Procurement

Howard Plante is a seasoned professional in the energy industry with a comprehensive background in environmental and energy engineering. As Vice President of Procurement at Freedom Energy Logistics, he brings a wealth of experience in regulatory compliance, technical analysis, and strategic planning to his role, where he is dedicated to advocating for clients and advancing the company’s enterprise efforts on their behalf. Click here to read Howard’s full bio.

Connect With Us