New England Energy Market Update: Spot & Futures Price Insights

While January 2025 was the coldest since 1988 across the US overall, and cold weather persisted through most of February, the three-month period March through May saw temperatures slightly above average by 1.1°F in the northeast. May produced several significant weather anomalies and events across the country. Just before Memorial Day weekend, a rare Nor’easter brought heavy rain to the Northeast, snow to New Hampshire’s highest elevations and set record-cold daytime high temperatures in several areas.

The persistent rainfall in May seemed to dominate the news with Manchester, NH totaling 10.27 inches, 3 times the normal amount. New Hampshire overall reported 13 Saturdays in a row with measurable precipitation as of June 13.

Spot Market Electricity Prices Decline with Mild Temperatures

As expected with mild temperatures, wholesale spot market electricity prices fell to relatively normal levels in March averaging 4.5 cents/kWh, just under 4 cents in April and 3.25 cents/kWh in May. Wholesale prices for the three-month period were higher than the previous 5 out of 6 years (with 2022 as the exception) as a result of elevated natural gas prices in comparison.

Table 1 depicts wholesale market electricity prices each month (through June 8, 2025) back to 2019.

Table 1

To kick off the unofficial start of summer, June 1 saw 10 hours of negative wholesale electricity prices staggered throughout the day in New England, averaging just under 2 tenths of a cent per kWh for the day.

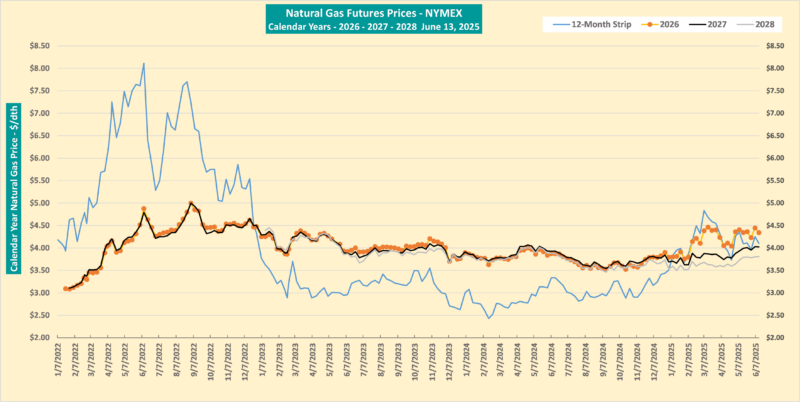

Future Energy Price Trends Across 2026, 2027, and 2028

As mild temperatures in New England preceded the very cold winter, electricity futures prices dropped considerably toward the end of March. Calendar year 2026 dropped over 0.6 cents per kWh in a two-week period from March 28 to April 11, with 2027 and 2028 seeing similar drops. But it was short lived; within a four-week period, prices rebounded back to the March 28 level for 2026, with 2027 and 2028 increasing by almost 1 cent per kWh in the same period following the trend of natural gas futures.

Futures prices for 2026 continue to stay above the 2027 and 2028 prices for both natural gas and electricity.

Table 2 depicts electricity futures prices for Calendar years 2026, 2027 and 2028 as of February 28.

Table 2 – Electricity Futures ISO-NE 2026 – 2027 – 2028

The Natural gas prompt month (April) price reached a high of $4.491 per dekatherm on March 10, pushing the 2026 Calendar Year price to $4.83/dth. With a relatively sharp turnaround, prompt month prices dropped significantly, reaching $2.94/dth by April 25.

Starting on an upward trend, prompt rebounded to $3.79/dth within two weeks, dropped to $3.11 and has continued a volatile path on a daily basis with 10 and 20 cent swings seemingly the norm.

Table 3 depicts natural gas futures prices for Calendar years 2026, 2027 and 2028, and the 12-month price July 2025–June 2026, as of June 13.

Table 3 – Natural Gas Futures 2026 – 2027 – 2028

Electricity prices in New England continue to generally track natural gas prices as expected, depicted in Table 4 through June 13.

Table 4 – ISO-NE Electricity and Natural Gas Futures Comparison – 2026

At the end of the first quarter, natural gas storage levels were below the 5-year average and almost at the 5-year minimum. As temperatures normalized going into March, levels rebounded as above average injections compared to the previous same periods replaced withdrawals. By mid-April, storage levels recovered above the 5-year average.

Table 5 – Natural Gas Storage as of June 6, 2025

Note: Electricity prices referenced here are energy-only and do not reflect a total electricity supply price that includes capacity, ancillaries, RECs, Fuel Security, etc. Additionally, natural gas prices referenced are NYMEX only and do not include basis and capacity costs.

Meet the Writer

Howard Plante

Freedom Energy Logistics

Vice President of Procurement

Howard Plante is a seasoned professional in the energy industry with a comprehensive background in environmental and energy engineering. As Vice President of Procurement at Freedom Energy Logistics, he brings a wealth of experience in regulatory compliance, technical analysis, and strategic planning to his role, where he is dedicated to advocating for clients and advancing the company’s enterprise efforts on their behalf. Click here to read Howard’s full bio.

Connect With Us