Freedom Energy Newsletter | december 2024

New England Futures Electricity and Natural Gas Price Summary

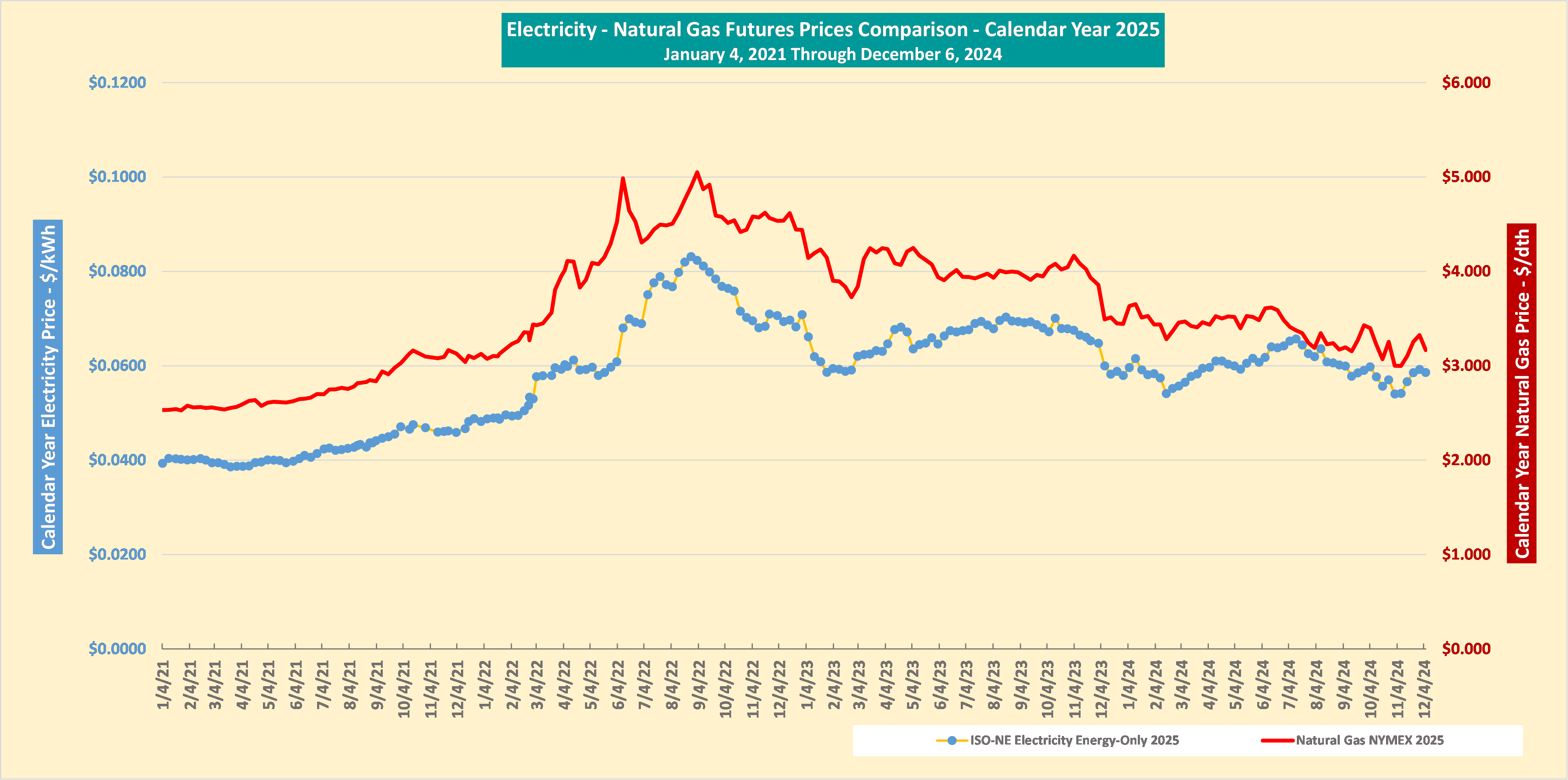

The first two months of Q4 2024 experienced some volatility in both natural gas and electricity futures prices. That trend continues daily as we head into December.

At the end of the first quarter, the electricity price for calendar year 2025 was trading at 6.0 cents per kWh, approximately where it was trading toward the end of January. By mid-July it had increased to 6.58 cents, a high not seen since November 2023. It then dropped to a low of 5.40 cents on November 1, just slightly below the 5.41 cent level in February and reaching a 32-month low just prior to the Russian invasion of Ukraine.

Since the low on November 1, 2025, prices rebounded close to the 6-cent level. 2026 and 2027 generally followed the same volatility with 2026 the highest of the three years.

Table 1 depicts electricity futures prices for Calendar years 2025, 2026 and 2027, as of December 6, tracked from January 2020.

Table 1 – Electricity Futures ISO-NE 2025 – 2026 - 2027

During the first three quarters of 2025, natural gas calendar year 2025, although with week-to-week volatility, remained relatively level trading between $3.40 per dekatherm to a high in mid-June of $3.59. During the period from September 13, where we saw 2025 trading at a 32-month low, to December 6, it reached a high of $3.429 to a low of $2.998 on November 8 and swung up to $3.325 at the end of November.

Table 2 depicts natural gas futures prices for Calendar years 2025, 2026 and 2027 as of December 6, tracked from January 2020.

Table 2 – Natural Gas Futures 2025 – 2026 - 2027

Electricity prices in New England continue to generally track natural gas prices as expected as depicted in Table 3 through December 6.

Table 3 – ISO-NE Electricity and Natural Gas Futures Comparison 2025 – 2026 - 2027

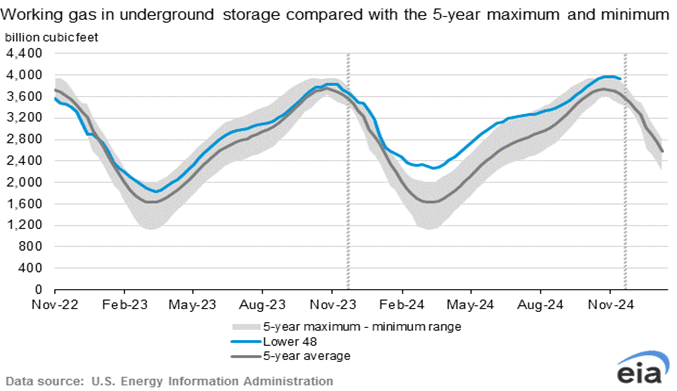

At the end of the third quarter, natural gas storage levels were below the 5-year maximum, but well above the 5-year average. With temperatures throughout most of the country this summer considerably higher than average with many areas breaking records, both for temperatures as well as extended durations of over 100 degrees, natural gas injections into storage overall were lower than expectations. However, during this 4th quarter, storage levels rebounded to above the 5-year maximum, a favorable position heading into the winter.

Table 4 – Natural Gas Storage as of November 29, 2024

Note: Electricity prices referenced here are energy-only and do not reflect a total electricity supply price that includes capacity, ancillaries, RECs, Fuel Security, etc. Additionally, natural gas prices referenced are NYMEX only and do not include basis and capacity costs.

Meet the Writer

Howard Plante

Freedom Energy Logistics

Vice President of Procurement

Howard Plante is a seasoned professional in the energy industry with a comprehensive background in environmental and energy engineering. As Vice President of Procurement at Freedom Energy Logistics, he brings a wealth of experience in regulatory compliance, technical analysis, and strategic planning to his role, where he is dedicated to advocating for clients and advancing the company’s enterprise efforts on their behalf. Click here to read Howard’s full bio.

Connect With Us